4 March (Part 4) - The quickest £100 (nearly) I ever earned

I have not paid Vehicle Excise Duty since I bought a tiny Kia in March 2012. Under £10,000 - those were the days - and

under the 100 gramme CO2 limit which exempted it from VED. Then I went electric

in September 2018 and literally own the oldest model of my car still on the

road. It has been absolutely faultless and has also been VED exempt.

Until Rachel Thieves came on the scene of course. She wants to charge me £195 a

year and the new rates start on All Fool’s Day. Small vans like the ones Royal Mail use will be £395.

Thanks to government greed, if you sell a car you lose any unused VED and the

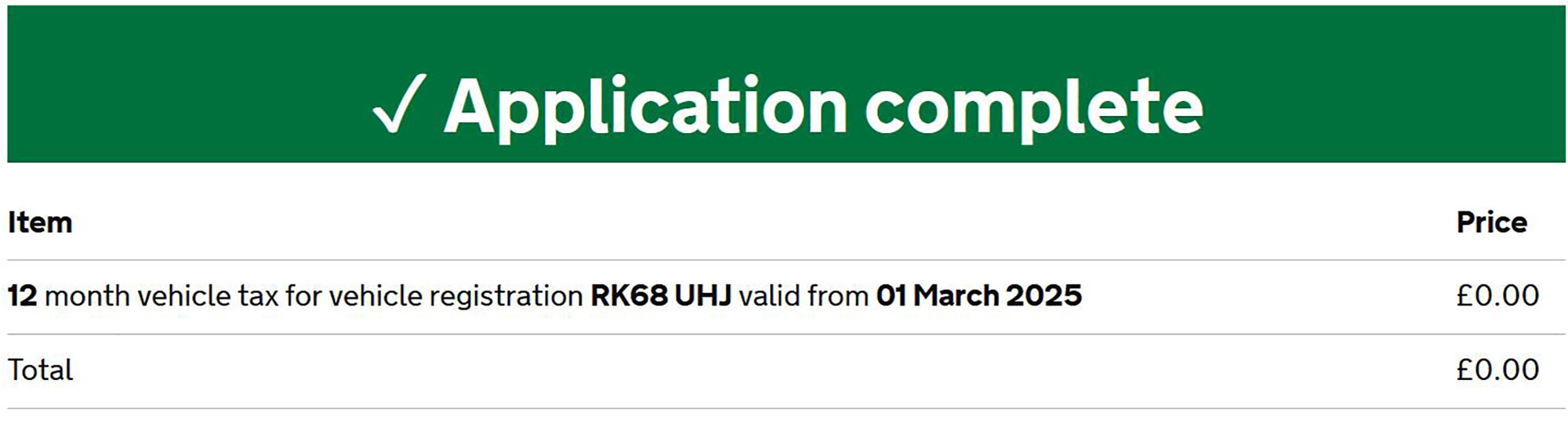

new owner has to pay it a second time. But you may in effect sell your tax exempt car to yourself,

forfeit the VED already paid - nothing! - and tax it again at the old rate.

Nothing! Play the bastards at their own game.

Just go to www.gov.uk/vehicle tax with

the eleven digit number from your V5C document, enter your registration number,

ignore the warning that you have already paid - nothing! - and pay nothing again.

In my case an extra six months free of VED. It literally took around 30 seconds to do.

Anyone with an older vehicle than mine (before 2017) that is currently free of VED will only be

paying £20 from April and owners should research the situation for themselves.

In some cases SORN may be advisable as that way you get overpaid tax paid returned.

Sorn lasts a minimum of five days before you can tax again.

Electric driving used to be cheap but in approximate terms and because my car

is very little used, VED will cost around six pence per mile, insurance in the

region of 32 pence and rising, annual servicing another six pence, tyres

about 2 pence and fuel well under a penny.

Not sure it is worth it to be honest, but I will not give in to effing politicians.